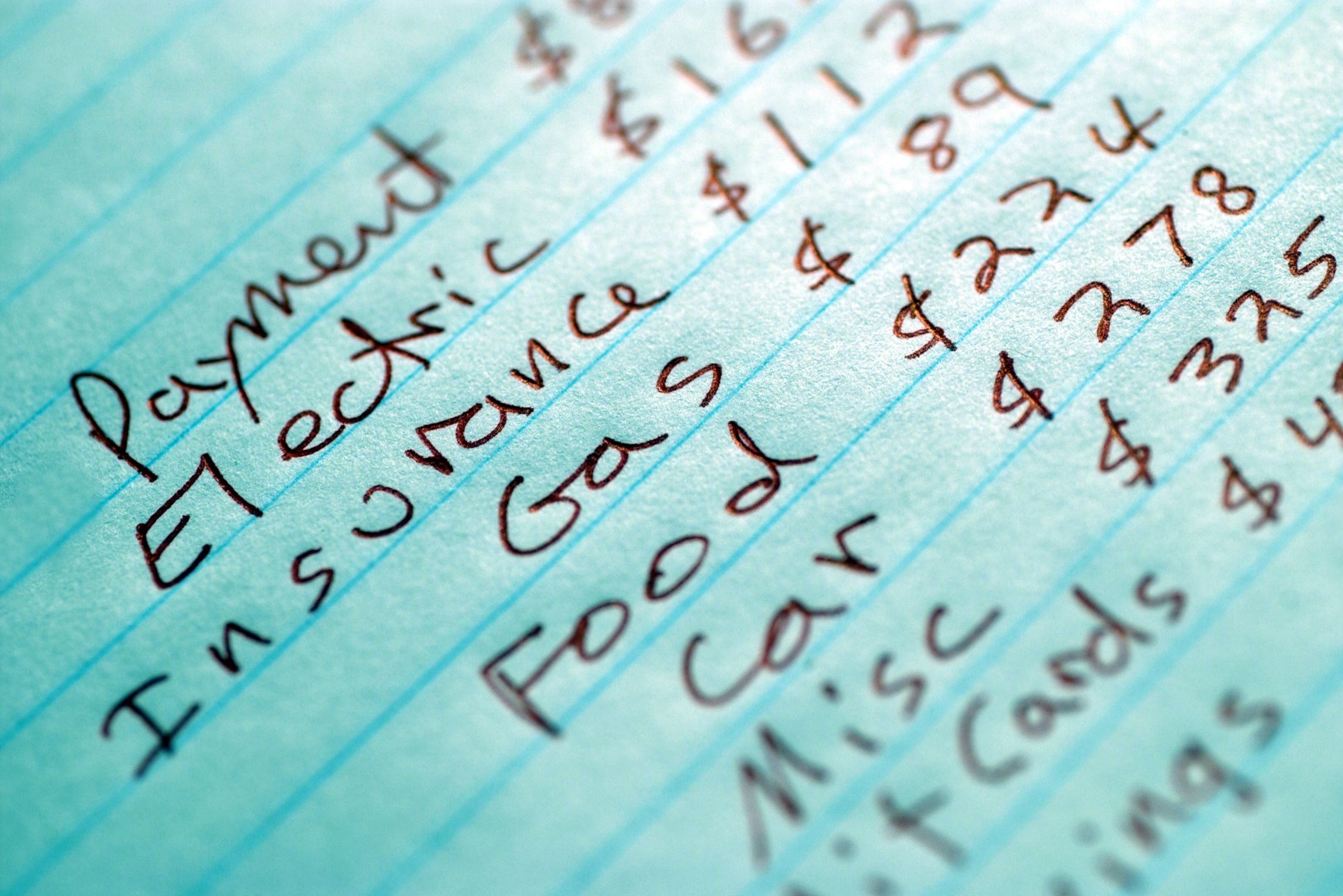

- Keep Tabs on Spending

Making your budget work is all about knowing exactly what you’ve got coming in and going out each month. If your income is relatively the same from paycheck to paycheck your primary focus needs to be on what you’re spending. You can utilize budgeting tools by taking note of your bill due dates on a calendar, setting up automatic payments or entering them into a budgeting software program. This is a good start but you also need to keep up with your everyday expenses.

- Define Your Goals

Living on a budget is certainly good for your financial health but it’s important to understand what yo

u want to achieve when you’re making one. Understanding what your priorities are provides some much-needed direction that will help you manage your cash more effectively, whether you’re a college student or managing a budget for your business. Your budget should ultimately reflect what your end goals are and how you plan to achieve them.

For instance, if you’re trying to pay off high-interest credit cards you’ll want to look for ways to cut your nonessential spending so you can redirect the money toward your debt. If you’re saving up for a down payment on a home your budget should reflect your time frame for reaching your goal. Whatever you’re working towards you need to make sure that your budget is designed to maximize the odds of success.

- Start Small

If you’re learning to budget for the first time it’s easy to feel overwhelmed, especially if you’re trying to do everything at once. When it comes to setting goals it’s tempting to try and tackle everything at the same time but you could be setting yourself up for financial failure. Instead of trying to do it all, focusing on one thing at a time allows you time to adjust to living on a budget and work out potential kinks.

The same is also true if you’re trying to reduce your spending. Cutting your budget down to the bare bones can certainly help you reach your goals faster but there’s a good chance it’ll leave you feeling deprived. Setting aside a little something for fun each month can help you avoid budget burn-out and keep your finances on course.

- Don’t Set It and Forget It

Making a budget is not a once and done thing, it’s a process that you’ll need to repeat on a regular basis. A slight decrease in income or an increase in one or more of your bills could leave you coming up short if you’re not paying attention. Taking a few minutes a day or an hour a week to review your finances can keep bills from slipping through the cracks and give you an idea of how well you’re keeping to your budget.